In today’s fast-paced digital world, staying ahead of the competition is crucial for businesses looking to succeed online. One of the most effective ways to achieve this is through search engine optimization (SEO) powered by artificial intelligence (AI). AI-driven SEO tactics offer a powerful tool that can significantly enhance website visibility and outperform competitors.

By utilizing machine learning algorithms, AI-driven SEO tactics collect and analyze data to boost a website’s search performance. These tactics enable businesses to optimize their websites for search engines and create compelling content that resonates with their target audience.

Let’s take a closer look at some smart AI-driven SEO strategies that businesses can employ to outsmart the competition:

Keyword Research: AI-driven tools can analyze competitors’ websites and identify commonly searched keywords. This valuable information allows businesses to optimize their website content using relevant, high-traffic keywords.

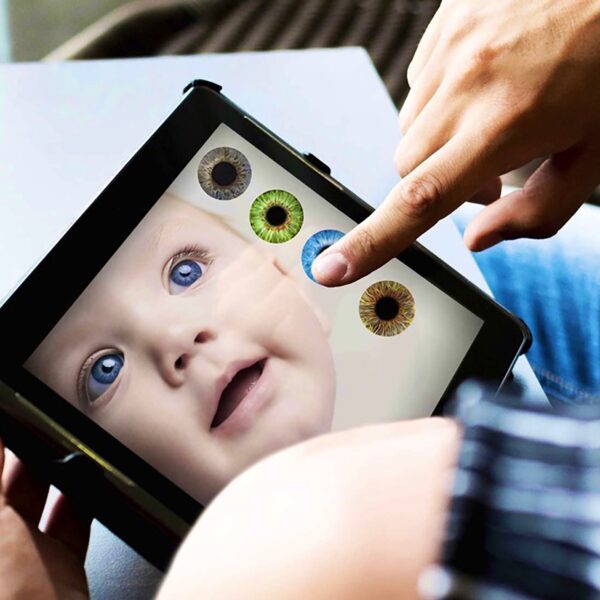

Natural Language Processing (NLP): NLP-based AI technology aids businesses in improving their website’s semantic search. By understanding the context and meaning behind words, NLP helps create content around topics and themes that customers are actively searching for.

Content Optimization: AI-driven tools can analyze a website’s content and provide actionable insights, such as identifying missing keywords or evaluating competitors’ successful content strategies.

Voice Search Optimization: With the growing popularity of voice assistants, AI technology can optimize websites for voice search by understanding natural language and common phrases.

The Power of AI-Driven SEO Strategies

Implementing AI-driven SEO tactics empowers businesses with a significant competitive edge in the digital marketplace. By leveraging data analytics, businesses can identify search trends and consumer behaviors to optimize their websites effectively and achieve higher search engine rankings.

Furthermore, AI-driven SEO enhances the user experience. By analyzing user behavior and search history, AI tools can suggest personalized content, improving engagement and creating a seamless customer journey.

In addition to these benefits, AI-driven SEO tactics offer a cost-effective solution for businesses. Instead of relying solely on costly pay-per-click advertising, implementing AI-driven SEO strategies can lead to long-term benefits through organic search results that drive continuous traffic to the website.

If you’re ready to seize the advantages of AI-driven SEO and propel your business forward in the dynamic realm of digital marketing, reach out to our NYC-based digital marketing agency. At the forefront of cutting-edge strategies, from SEO to influencer marketing, we are dedicated to optimizing your online presence. Contact us now to embark on a journey of sustained growth and elevated online visibility.