From a bird’s eye view, a large language model is a type of deep learning algorithm that was built to perform a number of natural language processing-related tasks. The technology can be used to recognize patterns that humans may have missed, for example. It can be used to summarize huge volumes of text into bite-sized chunks that are easier for people to digest. It can translate content from one language to another, generate new content of its own, and can even predict future trends by analyzing historical data.

LLaMA is one example of this type of solution in action. It’s a foundational, 65-billion-parameter LLM aimed at “helping researchers advance their work in this subfield of AI.” The Hugging Face open source LLM is another.

Because of their versatility, large language models have potential applications in just about every industry you can name. In healthcare, for example, they can be used to better understand someone’s lab work or test results in a way that helps quickly diagnose problems in a patient. In software development, they can be used to write code so that human programmers can focus on more important matters.

But of all the fields where large language models will be felt by average people, there are perhaps none more pressing over the short-term than e-commerce.

The Impact of Large Language Models on E-Commerce

According to one recent study, about 64% of people say that they’ll switch brands if they have just a single bad experience with a company’s customer service. There are few statistics that do better at explaining not only how large language models can be of use to e-commerce brands, but why they are so important in general.

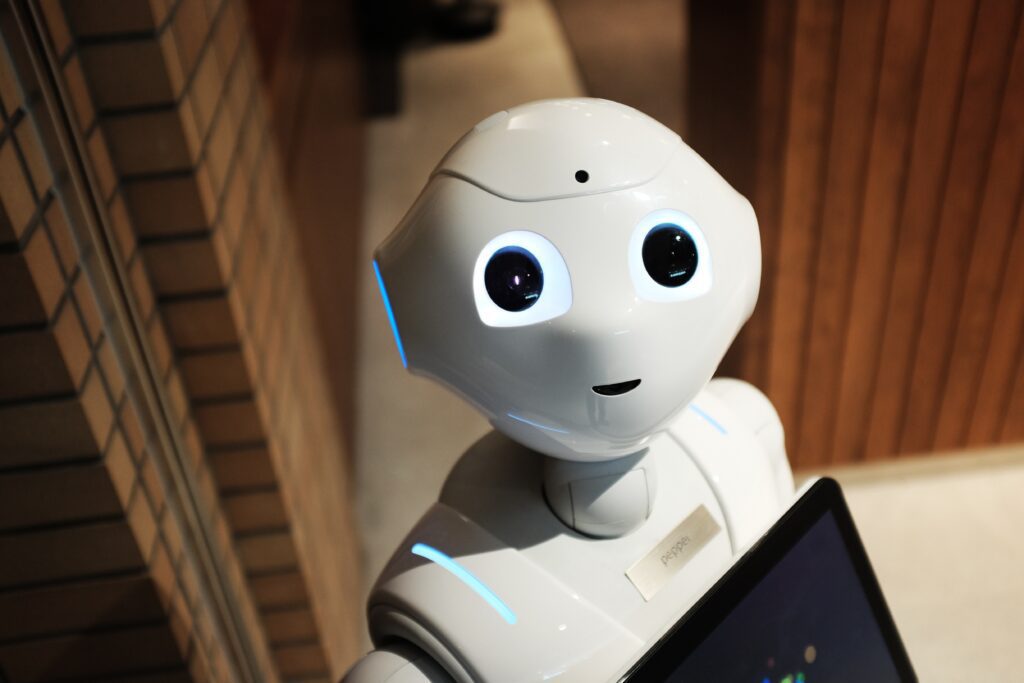

The most obvious current impact of LLMs in e-commerce takes the form of virtual shopping assistants. Large language models are the backbone of chatbots, which can not only understand natural human language but can also respond in kind. They can be used to quickly answer questions, address account concerns, fix a problem with an order that has already shipped, provide personalized product recommendations, and more.

If you’re an e-commerce business leader that is worried about a single bad experience sending someone into the arms of a competitor, the next step becomes clear. You replace as many of those elements as possible with LLM technology and virtual assistants that instantly become the best type of employees. They always have the right answer, they’re never in a bad mood, and they’re available 24 hours a day, seven days a week, 365 days a year.

But even going beyond allowing for improved (not to mention cheaper) customer service, LLMs have a role to play elsewhere in e-commerce, too. LLMs and natural language processing can be integrated into a e-commerce business’ search platform, allowing for more advanced capabilities that make it easier to find what someone is looking for. It can be used to automatically generate content for marketing purposes, making it easier to always get “the right message in front of the right person at the right time” through a deep, analytical understanding of who makes up a target audience.

Regardless of the application, the overall theme is clear. Large language models are being used to make the e-commerce experience easier, more effective, and more enjoyable for consumers and will continue to do so moving forward.

The Future of E-Commerce: A Brave New World

So where do we go from here? As large language models continue to advance, you can expect to see many of the advantages above do the same.

People will be able to interact with e-commerce chat-bots to do more than just answer basic questions or get product recommendations. They’ll be able to express doubts and get an appropriate reaction. They’ll be able to get more interactive than ever. They’ll essentially have a variation of the same conversation and experience they would have with someone in a physical store, just in a digital space.

It’s easy to envision a world where a virtual shopping assistant in a mobile app anticipates that you need a certain product before you even realize it based on not only your past purchasing history, but your past online behavior. One of the challenges with their implementation in e-commerce today is that modern LLMs are very dependent on prompts – that’s why they’re usually being employed in the context of chat-bots and search engines.

This will not always be the case. As more data is fed into them and more refinements are made, large language models will continue to improve and will thus improve the e-commerce experience for customers. This is not unlike the way that things shifted when a group of Reddit users employed the Robinhood app to disrupt the Stock Mark. They will be at the foundation of a movement to take e-commerce beyond an avenue for simple transactions and into the realm of an experience in and of itself. The act of shopping will become the product, not just a means to an end, and we will have large language models to thank.