As we are already approaching 2025, the New York City influencer marketing seems to undergo major changes. Brands today are waking up to the power of real emotions that fans have for them, and hence influencer marketing agency NYC is kick-starting a new change.

Influencers’ Niche in the Social Marketing Map:

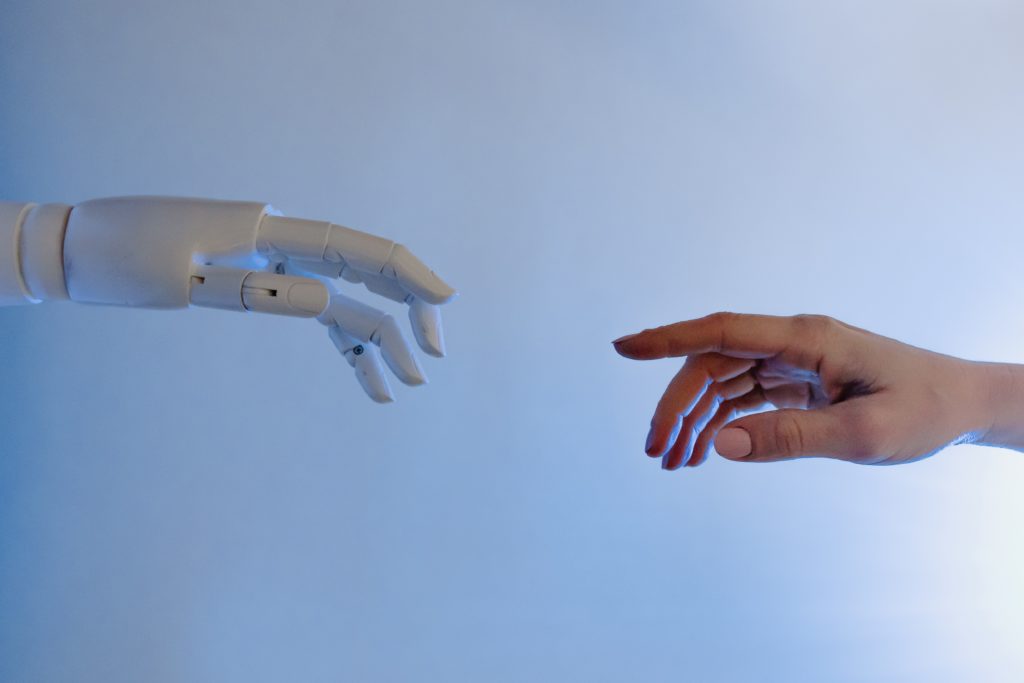

Integration with Artificial Intelligence (AI):

There are predictions that AI is going to significantly positively impact influencer marketing by improving data processing, audience selection, and campaigns’ performance. The agencies using AI can get to know who will be more effective and what results can be expected from a campaign much faster.

Rise of Micro-Influencers:

There is a trend towards the use of so-called ‘micro-influencers,’ who, although have fewer subscribers, have more engaged customers. This trend enables pro bono actual more natural and affordable associations

Performance-Based Campaigns:

There is an increasing concern over the identification of quantitative outcomes. Marketers are now using performance based solutions, to make sure that working with influencers is profitable.

Diversification Across Platforms:

Because social media channels have become popular, agencies’ knowledge is not limited to the conventional forms of media but also covers the new media for broader coverage.

Enhanced Transparency and Authenticity:

Clients and customers are becoming more savvy and this is entailing the agency to practice mutually beneficial partnerships and carefully avoid sneaky marketing endeavors.

Predictions for 2025 for the Influencer Marketing Sector:

Increased Mergers and Acquisitions (M&A):

Currently, there has been increased speculation on taking over of different companies in the influencer marketing sector, hence the combination of service provisions and acquisition of more capabilities.

Integration with E-commerce:

A new congruence of influencer content and direct shopping is likely to emerge where TikTok will play a critical role in social commerce.

Emphasis on Data Privacy:

As agencies continue to raise concerns over security of consumer information, agencies will be compelled to enhance robust security standards that are constitution with international data protection standards.

Colure Media: Leading the Charge in NYC

Luckily, the influencer marketing agency Colure Media, based in New York, is managing these shifting trends very well. Employing AI through its unique platform, Galileo™, Colure optimizes campaign effectiveness, and reach, targeting the correct audience and engaging them.

Their Comprehensive Suite of Services Includes:

Social Media Optimization (SMO):

With Colure’s expertise in SMO, its client’s brands remain strong and active online presence to have a real connection with their audiences. Content Marketing: Thus, Colure supports a brand and makes it close to the hearts of the target audience, through the telling of beguiling stories.

Mobile App and Web Development:

Based on the core concept of positive user experiences, Colure provides clients with the best development services so that brands can be easily navigated across the digital space.

In the rapidly evolving ecosystem of influencer marketing, Colure Media stands for new approaches, and transparency, and the agency’s focus places it among the leaders of the influencer marketing agencies in NYC. Their progressive strategies keep both a brand passionately involved, and relevant to industry trends, and offer best practice examples for engaging with the fans.